Blog

Gibbs Denley Investment Market Review & Outlook – July 2017

Political risk appears to have shifted from Europe and the US to the UK following the snap election which did not go entirely to plan for the Conservatives. This has largely been played out in currency, a theme which is likely to continue through negotiations. Due to the currency moves we have experienced since the referendum, the UK is now importing significantly higher inflation. This is likely to affect the consumer most of all as wage growth is far behind the increase in the cost of living.

Political risk appears to have shifted from Europe and the US to the UK following the snap election which did not go entirely to plan for the Conservatives. This has largely been played out in currency, a theme which is likely to continue through negotiations. Due to the currency moves we have experienced since the referendum, the UK is now importing significantly higher inflation. This is likely to affect the consumer most of all as wage growth is far behind the increase in the cost of living.

The Eurozone is experiencing rather less political risk now, having come through a number of elections year to date unscathed. Germany has an election in September which is not expected to cause any ripples, however the impending Italian election, expected early next year, has the potential to bring volatility as Italy is currently the least pro-Europe member of the bloc.

Aside from politics, US growth seems to be on track, with the Fed continuing on their interest rate rise path, suggesting the economy is performing in line with expectations. This also appears to be the case in Europe, Japan and Asia; all geographies in which we hold significant positions.

Read our full Market Review and Outlook contains a more detailed overview of the last 3 months and some of our thoughts for the next quarter:

Gibbs Denley Market Review & Outlook: July 2017

Gibbs Denley Market Review & Outlook: July 2017

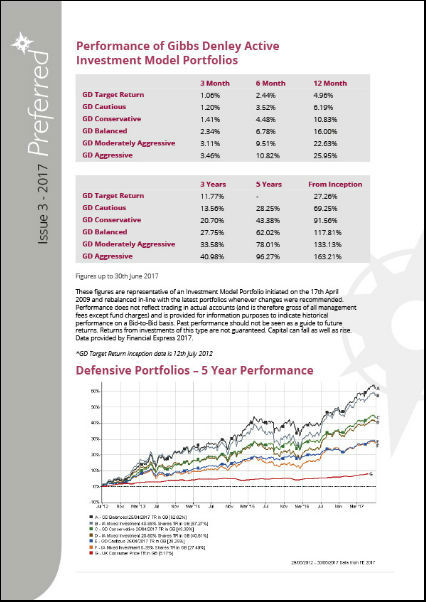

Gibbs Denley Market Review & Outlook Portfolio Performance

Tom Sparke IMC, CertPFS (DM)

Tom Sparke IMC, CertPFS (DM)

Investment Manager

Gibbs Denley

Newsletter

Sign up to have our latest content delivered straight to your email inbox.

.

.